By Herb Wiseman

Libs and Cons lament and wring their hands about balanced budgets, debts and deficits. The heritage of the NDP should lead it to lament and wring its hands on the transfers of taxpayers’ dollars to the wealthy in the form of interest on the debt but it doesn’t. The media are complicit in manufacturing consent for this practice and the narrative rather than exposing it.

The first part of this series exposes and challenges the narrative and the second part looks at whom it serves – its purpose and how we got there. The NDP has not governed the country and have never introduced a budget so their true intentions are not known in this regard. Balancing budgets usually means robbing from items in the budget to reduce a deficit but the one thing never touched is the interest payments on the debt. All the others are subject to reduction but not the money paid to the wealthy in the form of interest on the debt!

Part 1: Eyes Wide Shut

In their budgets the Libs and Cons always emphasize spending taxpayers’ dollars wisely whereas the NDP criticizes them for spending on the wrong priorities. But they all talk about balancing the budget by ending deficit spending and then using surpluses gained by cutbacks to reduce the debt. That narrative is taken up by the media and dominates the discussion and we are left with our eyes wide shut. It is a red herring meant to obscure what is really going on. Indeed, this frame is widely accepted without questions by even the left-wing pundits.

Part of this narrative includes conversations about how much should be spent on different areas but the one item never discussed is the amount of interest paid on the debt and who gets that money. The interest on the debt is never adjusted.

For example, Jim Stanford in an otherwise excellent recent CCPA article, “The Five Most Outrageous Things About the Conservative Budget,” ignored the transfer of tax dollars to the wealthy. He admitted “it’s hard to even know where to start” to comment on such a “galling, short-sighted and ultimately destructive…federal budget….”

He focused on tax and spend differences between the CCPA Alternative Federal Budget and the government budget stating “The question is not whether to ‘tax and spend’ but whom we will tax and what we should spend it on” highlighting the unfairness of the government budget’s allocations. The article was reproduced in the May-June issue of ER (see comer.org) and his third item was the “Phony Balance” in the budget. He correctly described some problems in his fifth item “More Stealth Austerity” but that again is part of the conventional balanced budget/deficit/debt narrative because the argument is that we need to cut back to eliminate the deficit or pay down the debt. His report for UNIFOR also ignores the amount of interest on the debt. It even adopts the government strategy to obscure this further by talking about the debt as a percentage of GDP. Somehow it is better when the debt is a smaller percentage of the GDP. That frame obscures the real problem.

The article by Warwick Smith in the same edition of ER, talked about money creation and spending without addressing the interest issue.

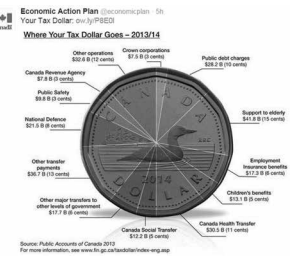

Hidden from plain view is the transfer of tax dollars in the form of interest on the debt. Even when the budget is balanced, huge sums of taxpayers’ money are being transferred to the wealthy money-lenders. In the current budget the amount of interest is $25.7 billion (in 2013/14 it was $28.2 billion) and, if a deficit is in the offing as reported by the budget officer, this amount is climbing. Furthermore, the current budget adds almost $20 billion to the country’s market debt of $620 billion. While there is some attention paid by the media to the $150 billion added to the debt during the 11-year rule by the Cons, nobody noted the increase to the market debt in this budget. Nor has anyone added up the amount of interest paid during the recent 11 years nor since we secretly changed the role of the Bank of Canada in the mid 70s under Trudeau Senior! How much was taxed back if any? We do not know. Recent business news has speculated on when interest rates will begin to rise. When they increase, theamount of interest owed on the debt and transferred to the wealthy will increase. How much has gone so far to the 1% or even the top 10% in lock-step with the increase in national debts? How has this transfer contributed to the inequality that has been growing since the mid 70s?

As part of his current election support for the Liberals, an early effort was made by Ralph Goodale to trumpet his past success in achieving balanced budgets. He stopped – perhaps because I replied to his post that his budgets transferred even more money than the Cons to the wealth classes. He transferred more than $34 billion in his “balanced” budgets on a lower debt of $500 billion – likely because interest rates were higher then. Now that we are likely in a recession, the deficit may return but if we should emerge from the recession, and prosperity should be on the horizon, interest rates will increase and the amount of money transferred to the wealthy as interest on the debt will rise – perhaps dramatically to the levels Ralph Goodale experienced or the even higher levels of his predecessors.

People will celebrate the return to balance and ignore the real ongoing problem of large amounts of our tax dollars being transferred to the wealthy as interest on the debt. That debt is the reason we are told we cannot afford the programmes and infrastructure Canadians need. It underpins inequality.

At COMER we often join the narrative of the parties but point out that if the government borrowed from the Bank of Canada (monetary policy), the spending of the borrowed money would be interest-free and that the stealth austerity that Jim Stanford deplored, would be avoided. At the end of the Stanford article, our comment correctly criticized the Alternative Federal Budget’s failure to include monetary policy and only focus on fiscal policy. But we also ignored the transfer of tax dollars to the wealthy. Instead we try to sell an alternative narrative about money creation and the historical role of the Bank of Canada that would reduce or eliminate the transfer of tax dollars as interest on the debt but this subtle shift in the narrative is harder for people to understand. We are still part of the mainstream narrative about tax, spend, balanced budgets, deficits and debt repayment in the same way that Smith does. In our comments, we seem to believe that it is out of a lack of knowledge and ignorance that this is occurring. That will be addressed in more detail in Part II of this series.

When Paul Hellyer used to present on this topic, he would ask, as have I, “When you go to the bank and borrow money, where does the bank get it from?” We all know that people usually say from other depositors or the Bank of Canada and we then politely correct them telling them that it is created out of thin air and explain why that is a problem. But recently I have started to ask, “The current budget is allegedly balanced. Do you know how much interest is still being paid on the debt and to whom?” People don’t know and when asked to guess usually underestimate the amount. They are shocked when they hear the number and have asked more than once, “every year?” They know that it is unfair especially when they realize that the wealthy are avoiding taxes on this interest and sometimes park the money in off-shore accounts. The debt service charge number is so big that it boggles the mind. It is the third highest budget amount behind Seniors and Health and more than Defense. When they realize that there is an alternative, they usually ask, sometimes rhetorically, why are we not doing that instead? That explanation will be explored more fully in Part II.

The assumption is often that the government does not know what it is doing. Perhaps. But politicians and civil servants are subject to their own lack of confidence at the individual level when it comes to numbers and face pressure from the media to put forth only a certain face on the topic. They do not find it easy to think through the problem. So they engage economists to advise them and allow lobbyists to influence and shape their policies. Thus, COMER’s efforts to educate them do not accomplish much. People in general, and politicians in particular are reluctant to engage in this intellectual struggle. Once they have a narrative they understand and that is also popular with the media and public, why challenge it? That mainstream narrative also includes: “therefore we must practice austerity, stealth or otherwise, and tighten our belts to pay down the debt.” This is code for cutting programmes and services in the budget and is a message for the people to reduce their expectations. Recently some writers have noted that tax evaders park their money off-shore and these writers want the government to crack down on the evaders which is a laudable activity and part of the narrative. But if we were to apply the entire current amount of interest being paid on the debt to the balance owing, it would take 25 years to pay it down. Under the present budget, there is no provision for paying down any of the debt and indeed almost $20 billion has been added to it. If we were to generate $10 billion annual surpluses, it would take 62 years to pay down the current debt using just surpluses. If the goal is a balanced budget, there are no surpluses. Paying down the debt then becomes a line item in the budget.

But at COMER we know a better narrative. The Bank of Canada can hold all or part of the debt because the interest paid is returned to the government.

The debt can sit there forever and we can pay interest on it forever but governments can decide how much of our tax dollars as interest should be transferred back to the government versus being transferred elsewhere. For example, we may think it is a good idea for the CPP and other pension funds to receive some of that interest during a time of economic downturn to shore up the pensions of Canadians when pensions are at risk from recessions and economic upheaval. So we would allow them to acquire treasury bills or members of the public to hold Canada Savings Bonds in their RRSPs or TFSAs as at present. That could be restricted for economic reasons at other times. But we need to be able to talk about these options that are currently not on the table.

Last year a large credit card company offered me a year’s worth of interest-free purchases on my unpaid balance as long as I paid the minimum payment each month. I noticed on-line that there is an advert for another credit card company to do the same thing now. If you run a balance on your purchases, there is no interest charged to you for one year. If you pay the balance off at the end of the year, the money for those purchases was loaned to you interest-free. If you don’t pay it off at the end of the year, the interest rate becomes 19.9% on the unpaid balance. In the past, I have had offers from credit card companies to transfer the balance from one credit card to another at a very low interest rate of 2.99%, 1.99%, 0.9% or even 0% for a limited time plus a flat fee of 1% or 2% on the amount transferred. Of course, the hope is that people will not pay the balance off at the end of the year but will have run up a large balance earning the credit card company a hefty amount of money in compound interest.

But when those of us who pay the balance off do so, the credit card company still wins because it has that money available to invest or use as leverage for more lending. It is likely that only those people with a proven track record for paying their minimum payments on time receive these offers because some of my clients with poor credit histories do not receive them. This may offer a clue to what is behind the narrative about balanced budgets and deficits and will be explored further in Part II. Canada has a proven track record with a positive payment history. Canada, unlike Greece, is considered risk-free so is not required to put up collateral when borrowing unlike the recent agreement Greece made with the EU.

If the Bank of Canada were to acquire the privately held public debt, what would be the impact on that money (QE or Quantitative Easing) being available in the private sector? The private sector has had huge tax breaks that have not been translated into new investment and thus have not contributed to job growth as we were told by Harper it would. If the private money-lenders no longer had access to government bonds and treasury bills, where would they invest that money? Would it all go to dividends or to purchasing back their shares or to CEOs or to new equipment and software or corporate takeovers? This then has implications for fiscal policies, labour policies and union contracts.

Hopefully Part I of this article stimulates discussion about another narrative than the balanced budget/deficit/debt one and will prompt some further research into the questions raised.

In Part II we look at how and why business leaders used their media to manufacture our consent for this misleading narrative.

Herb Wiseman is COMER’s information officer, and a long-time member of COMER.