Readers are encouraged to review Joyce Nelson’s article, “The Government’s Proposed Infrastructure Bank: A 21st Century Trojan Horse,” COMER, March-April 2016.

$40 billion in Infrastructure Funding Urged

By Bill Curry, Sean Silcoff, Ottawa, The Globe and Mail, October 21, 2016

- Expert panel on economic growth predicts ambitious bank proposal could deliver more than $200 billion in projects over coming decade

- Previous government efforts to attract private investment have had limited success, with pension fund managers saying Canadian projects too small

An expert panel on economic growth is calling on the government to launch an ambitious national infrastructure bank capitalized with $40 billion in federal funds aimed at attracting major institutional investors.

The proposal to entice global pension funds into major Canadian investments goes far beyond anything promised to date by the federal Liberals, but Finance Minister Bill Morneau – who worked directly with the panel over the past several months – signalled a strong openness to the recommendations announced Thursday.

The Advisory Council on Economic Growth released three reports calling for the national infrastructure bank, a greater effort to attract foreign investment and a major boost to immigration.

Mr. Morneau said he’s prepared to act on some of the ideas as soon as November 1, when he will release the fall fiscal update; November 1 is also the deadline for Ottawa to announce its 2017 immigration targets.

The goal of the recommendations is to increase economic growth at a time when the Bank of Canada has once again lowered its expectations to 1.1 percent this year and 2 percent in 2017.

The council predicts an infrastructure bank could raise private capital at a four-toone ratio to deliver more than $200 billion in infrastructure over the coming decade with a focus on projects worth at least $100 million.

Ottawa’s previous efforts to attract private infrastructure investment – including through an agency focused on public-private partnerships – have had limited success. Pension fund managers say Canadian projects to date have simply not been big enough.

However, the panel’s 14 members include leaders of some of those institutional investors, including Mark Wiseman, senior managing director of BlackRock Inc., and Michael Sabia, CEO of the Caisse de dépôt

et placement du Québec pension fund.

Examples of potential projects listed on Thursday include toll highways and bridges, high-speed rail, port and airport expansions, city infrastructure, national broadband infrastructure, power transmission and natural resource infrastructure.

The report also says the bank could issue infrastructure bonds as a way of raising its own capital to invest. Another key recommendation is a suggestion that Ottawa should privatize – in full or in part – some of its existing assets as a way of raising money that could be spent on other infrastructure priorities.

That advice comes as the government recently hired Credit Suisse AG to analyze several privatization options for Canadian airports.

Mr. Morneau said the airports study is preliminary work and indicated Ottawa is not yet committing to any asset sales.

“As we think about how best to amplify our impact on infrastructure investment in this country, we need to create ways for institutional investors to invest in our country,” he said. “So we’ll move forward in a way that will allow us to attract institutional money and it’s not conditional on any other government activity around government assets.”

The council is chaired by Dominic Barton, global managing director of the consultancy McKinsey & Co. As The Globe and Mail reported earlier this week, the council’s recommendations also include a call to boost immigration by 50 percent to 450,000 a year and to launch a department aimed at enticing foreign direct investment into Canada.

“Now’s the time when we have to take very bold actions,” said Mr. Barton, explaining that demographic changes will produce a period of prolonged slower growth that requires a policy response. “They may not be

new. These [ideas] have been talked about before, but they haven’t been done. And so what we’re keen to do is to jolt it.”

Federal Immigration Minister John McCallum made it clear this week that he will not follow through on the council’s call to boost immigration by 50 percent to 450,000 a year.

“That’s an enormous number,” Mr. McCallum told reporters Wednesday. He said many stakeholder groups have urged him to increase Canada’s current immigration target of 300,000, but many Canadians have also said they do not support a major increase. He also said there is a significant federal expense in accepting more immigrants.

In its white paper titled “Bringing Foreign Direct Investment to Canada,” the council recommends creating an FDI agency to attract “anchor companies” to invest here, and to develop an accompanying strategy to attract the investment. “These actions would bring much-needed coherence to what is currently a disjointed approach to foreign investment,” the council report says, adding that such a strategy could increase GDP by $43 billion.

In addition to recommending increased immigration levels, the council also called on government to make it easier for skilled foreigners to immigrate to Canada. Foreign executives, programmers and other sciencebased professionals typically now wait between six and 12 months to have their work permits approved. The council called for wide-ranging exemptions for those recruits from a cumbersome, time-consuming immigration process that requires employers to prove they can’t find a Canadian to fill the job before offering it to a non-Canadian. The council also said foreign students studying in Canada should have an easier time applying for permanent residency after their studies are complete.

Edmonton Mayor Don Iveson, who chairs the big city mayors’ caucus of the Federation of Canadian Municipalities, said cities should be involved in the design of any new infrastructure bank. He also noted that

many types of municipal infrastructure are not likely to attract investors.

“Public good infrastructure is going to be difficult to finance using an infrastructure bank,” he said.

Canadian Union of Public Employees president Mark Hancock said in a statement that he strongly opposes the call for an infrastructure bank and asset privatization, calling it “a recipe for the cannibalization of Canada’s public infrastructure.”

“Nowhere in the report does it mention that investors in these schemes demand a much higher rate of return than the government can borrow at,” he said, warning it will lead to new user fees on Canadians.

Doug Porter, chief economist at Bank of Montreal, said the proposals, if implemented, would not have much impact on the economy in the short term, but they could improve Canada’s outlook over a longer period.

“We are dealing with a relatively sluggish global economy that is impeding exports, and there is very little we can do about that,” he said. “Here in Canada we are dealing with fundamentally sluggish productivity growth and changing demographics, which are leading to slower labour force growth. Those two things are very difficult to turn around.”

Our Comment

The Canadian Infrastructure Bank is indeed an ambitious bank proposal – a bold move to consolidate the neoliberal victories of the past four decades and to ensure their benefits long-term.

The CIB will exemplify the neoliberal principles of privatization and the limited role of government.

It will amplify the financialization of the economy and reduce most Canadians to debt serfs (Guess who will pay the interest on those infrastructure bonds!)

The trend to the “toll-road economy,” “represents a return to a feudal-landlord economy of unearned profits from rentseeking” (Ellen Brown, Web of Debt, quoted by Joyce Nelson, COMER, March-April 2016).

Small wonder that Dominic Barton and his confederates are “keen” to “jolt” it!

Why not provide opportunities for Canadian unemployed students to acquire the skills suited to emerging needs? Why should young Canadians – many of whom have to graduate debt slaves to afford post-secondary education – have to compete for work with foreign students who, presumably, can afford to study abroad?

The observation that investors will not likely want to invest in “public good infrastructure” raises the important issue of priorities.

Could the fact that “investors in these schemes demand a much higher rate of return than the government can borrow at” have a bearing on why the Bank of Canada won’t do?

“As I see it, the governments of Canada have broken three fundamental financial rules. These rules are:

1. No sovereign government should ever, under any circumstances, borrow money

from any private bank.

2. No Canadian, provincial, or local government should borrow foreign money when there is excessive unemployment here…. Deficits should be financed internally and largely through the central bank.

3. Governments, like businesses, should distinguish between “capital” and “current expenditures,” and when it is prudent to do so, finance capital improvements with money the government has created for itself (Professor John H. Hotson, 1930-1996, Professor Emeritus of Economics, University of Waterloo, Ontario, and Past Executive Director of COMER).

Élan

How Not To Fund Infrastructure

By Michal Rozworski, The Bullet, Socialist Project, E-Bulletin 1296, August 26, 2016

Recycling is supposed to be a good thing, so when the federal Liberals quietly announced that “asset recycling” would be part of their strategy for meeting their muchballyhooed infrastructure promises, not many eyebrows were raised. They should have been. Asset recycling is an obscure code word for selling our public goods for private profit. It’s privatization by another name.

Don’t have the taxes to pay for new buses? It’s okay, you can sell your electricity utility to pay for them instead. In fact, this is precisely what the Ontario Liberal government is doing. Already 30 percent of the profitable Hydro One have been sold and another 30 percent will be sold before 2018. A public Hydro One could more directly fight climate change, lower energy costs for the poor or work with First Nations on whose lands generation often happens. A private Hydro becomes an instrument for profit first with other goals secondary.

What the Liberals have started in Ontario will soon be rolled out across Canada. Here are the problems with these schemes.

Cut Taxes to Create a Funding Crisis

First, there is no crisis that says you have to sell a bridge to fund a hospital or the other way around. Or, better put, we have manufactured crises. Decades of slow but crippling austerity, tax cuts and restructuring have led us here. We cannot afford transit and hospitals by choice and it is in our power to reverse things. Deficit spending can be part of a reversal in the short term; asset recycling cannot.

Second, remember that we need more infrastructure spending because what we have is often crumbling and the economy faces gaps in demand. Investment in infrastructure not only creates useful things we depend on, it also creates demand for materials and jobs, which themselves create – you get the picture. Business isn’t investing, so there is a big role for public investment. Keepers of global order like the OECD and the IMF have recognized this. The IMF was applauded recently for walking back its support for austerity. Rightly so, but the same document reaffirmed support for privatization. Canada’s Liberal Party is really at the forefront of this policy shift by elites.

However, getting funds for investment by selling other assets into a system that has created massive asset price inflation – seen in stock markets at record highs, a lack of sub-million dollar homes in Vancouver or smashed art auction records – seems questionable at best. The response to the global financial crash of 2007-08 saved the world from depression but left fundamental inequalities in place.

Third, shares in newly-privatized public enterprises can become bargaining chips. Asset recycling has already created space for new and refined forms of triangulation, with worse to come. The latest batch of Hydro One shares in Ontario will be sold at a slight discount to First Nations for loaned funds. What seems like new funding is, however, a cynical one-off.

This is the Ontario government effectively saying, “we’ve underfunded your schools and clinics, poisoned your rivers and abandoned your communities, let’s make it right by helping us privatize Hydro.” Beyond slightly accelerating the sale of Hydro and coming at low political cost (the government gets a slightly smaller share of privatization income, rather than making explicit expenditure on First Nations), this scheme does nothing to address real grievances First Nations might have with Hydro. Seats on the Board of Directors or other regulatory bodies, deeper co-governance arrangements, priority hiring – none of this is on the table and neither is new, stable funding.

Pension Funds on the Prowl for ‘Investment Opportunities’

Finally, here’s a quote from an investment manager in a Maclean’s piece on asset recycling:

“‘If you took a road that used to be free and you tolled it, I think consumers are right to say, ‘Hey, that used to be free and now it’s being tolled, that’s unfair,’’ he said.

“‘But let’s remember that governments need to balance their books somehow…. I don’t think they can raise taxes too much more. I don’t think any of us want that.’”

Typical right-wing talking points. The problem is that these typical right-wing talking points are coming from someone ostensibly representing union workers: this investment manager works for the Ontario Teachers’ Pension Plan. Canada is a world leader when it comes to workers’ own pensions being turned against them and younger generations. What were once simple, safe pension investments in government bonds are today predatory arrangements with pension boards acting more like hedge funds. Asset recycling only accelerates this process and binds regular people more tightly to a system that ultimately works against them. [Editor: see “Pension Funds and Privatization,” LeftStreamed No. 194.]

So, too few buses in your city? Sell an airport. First Nations have inadequate health facilities? Here’s a few Hydro shares. Need a pension? Buy a highway…and don’t forget to contract out the maintenance and toll staff to make sure you’re earning maximum returns. As a friend put it, “Trudeauism is able to sublimate both neoliberalism and social democracy into itself.” Just so, asset recycling is the wrong answer to each of the above good questions.

Michal Rozworski is an independent economist, writer and organizer. He currently works as a union researcher in Toronto, blogs at Political Eh-conomy, where this article first appeared.

Our Comment

Bad policies lead to crises – crises lead to worse policies. How bad does it have to get, before we rise to the challenge?

Élan

Liberals Eye “Asset Recycling” and Privately Owned Infrastructure

By Brent Patterson, rabble.ca, June 17, 2016

The Canadian Press reports:

“The federal government has identified a potential source of cash to help pay for Canada’s mounting infrastructure costs – and it could involve leasing or selling stakes in major public assets such as highways, rail lines, and ports. A line tucked into [their] federal budget reveals the Liberals are considering making public assets available to non-government investors, like public pension funds. The sentence mentions ‘asset recycling,’ a system designed to raise money to help governments bankroll improvements to existing public infrastructure and, possibly, to build new projects.”

CUPE has previously explained:

“Asset Recycling is a new phrase describing corporatization, marketization and privatization of government assets. An asset is ‘recycled’ when a government, corporation or bank either sells or borrows against its physical assets to get money for investment in new capital…. Asset recycling is just another scheme driven by bankers and governments desperate to hide past failures of neo-liberal privatization policy.”

The term “recycling” comes from the notion that, as described by the Mowat Centre, governments “dispose of legacy assets to generate capital to invest in new assets or to refurbish existing infrastructure.”

The clearest example of this may be the Ontario Liberal government selling 60 percent of Hydro One, the provincially owned electricity transmission utility, to generate funds to spend on transportation infrastructure. The grim truth is that a publicly owned utility that generates about $750 million a year in “profit” and puts another $100 million a year in the provincial treasury in lieu of taxes is being privatized. Federally, just a few examples of Crown corporations (state owned corporations) that could be subject to asset recycling include Atomic Energy of Canada Limited, Canada Post Corporation, the Canadian Broadcasting Corporation, the Halifax Port Authority, and Via Rail.

Another Canadian Press article examines more closely the issue of public pension fund investments in public infrastructure.

That article notes:

“The Trudeau government’s newfound enthusiasm about a big Montreal transit proposal has given Canadians a glimpse at one way Ottawa could fund billions in public infrastructure…[Quebec’s public pension fund manager], the Caisse de depot et placement du Quebec, is prepared to pump $3 billion into [a $5.5 billion lightrail plan for Montreal] – and it wants the provincial and federal governments to kick in the rest…. A subsidiary of the Caisse would operate the rail network and gradually recoup the pension plan’s investment through user fees. Eventual profits would be funnelled into Quebecers’ public nest egg – the Quebec Pension Plan – which is managed by the Caisse.”

Finance Minister Bill Morneau says, “I salute the innovative efforts of the Caisse de depot et placement du Quebec, which, through its metropolitan electric network, is proposing a new business model to implement major infrastructure projects.” And Infrastructure Minister Amarjeet Sohi says, “I see this as a great opportunity for us to support innovation in delivery of infrastructure, because we do need to engage public sector pension funds, as well as private sector funds, to make sure the amount of infrastructure that we build across the country engages other stakeholders and partners.’’

We do not share the enthusiasm of these ministers for this model.

The Montreal transit project is not a public-private partnership nor the privatization of an existing publicly owned asset. But it is just as problematic that the ownership and operation of this new rail line will be in private, for-profit hands from the start. We believe that public services and public infrastructure, including transportation infrastructure like this rail line, is most efficiently operated on a publicly owned and democratically accountable basis. The involvement of a public pension fund does not change the reality that the service is to be operated and controlled by a for-profit corporation.

It should also be noted that pension fund companies do not pay income taxes on their profits. That’s why in some instances pension funds take the lead in a consortium with tax-liable corporations in order to shield the entire consortium of investors from their obligation to pay taxes. That is not fair and hurts the public purse.

CUPE has stated:

“The Liberals are clearly hoping that Canadian pension funds could become privatizers of infrastructure…. CUPE strongly opposes this concept. Privately-owned and operated infrastructure will result in more expensive, lower quality, less accessible services for Canadians. We are strongly opposed to privatization, whether the private owner of the infrastructure is a profit-seeking corporation or a worker’s pension plan. In either case it is wrong; if future infrastructure improvement and development is to truly benefit all Canadians, it must be publicly owned and run.”

Our Comment

To what extent this project and others like it will lead to a further looting of the commons will depend on how soon Canadians address the need to sort out an acceptable balance between private profit and the common good.

“Public infrastructure should be publicly funded through new money borrowed at the government-owned Bank of Canada, paying near zero interest rates – just sufficient to cover the bank’s running expenses.”

John Hotson

Monopoly’s New Era

By Joseph E. Stiglitz, Project Syndicate, May 13, 2016

New York – For 200 years, there have been two schools of thought about what determines the distribution of income – and how the economy functions. One, emanating from Adam Smith and nineteenth-century liberal economists, focuses on competitive markets. The other, cognizant of how Smith’s brand of liberalism leads to rapid concentration of wealth and income, takes as its starting point unfettered markets’ tendency toward monopoly. It is important to understand both, because our views about government policies and existing inequalities are shaped by which of the two schools of thought one believes provides a better description of reality.

For the nineteenth-century liberals and their latter-day acolytes, because markets are competitive, individuals’ returns are related to their social contributions – their “marginal product,” in the language of economists. Capitalists are rewarded for saving rather than consuming – for their abstinence, in the words of Nassau Senior, one of my predecessors in the Drummond Professorship of Political Economy at Oxford. Differences in income were then related to their ownership of “assets” – human and financial capital. Scholars of inequality thus focused on the determinants of the distribution of assets, including how they are passed on across generations.

The second school of thought takes as its starting point “power,” including the ability to exercise monopoly control or, in labor markets, to assert authority over workers. Scholars in this area have focused on what gives rise to power, how it is maintained and strengthened, and other features that may prevent markets from being competitive. Work on exploitation arising from asymmetries of information is an important example.

In the West in the post-World War II era, the liberal school of thought has dominated. Yet, as inequality has widened and concerns about it have grown, the competitive school, viewing individual returns in terms of marginal product, has become increasingly unable to explain how the economy works. So, today, the second school of thought is ascendant.

After all, the large bonuses paid to banks’ CEOs as they led their firms to ruin and the economy to the brink of collapse are hard to reconcile with the belief that individuals’ pay has anything to do with their social contributions. Of course, historically, the oppression of large groups – slaves, women, and minorities of various types – are obvious instances where inequalities are the result of power relationships, not marginal returns.

In today’s economy, many sectors – telecoms, cable TV, digital branches from social media to Internet search, health insurance, pharmaceuticals, agro-business, and many more – cannot be understood through the lens of competition. In these sectors, what competition exists is oligopolistic, not the “pure” competition depicted in textbooks. A few sectors can be defined as “price taking”; firms are so small that they have no effect on market price. Agriculture is the clearest example, but government intervention in the sector is massive, and prices are not set primarily by market forces.

US President Barack Obama’s Council of Economic Advisers, led by Jason Furman, has attempted to tally the extent of the increase in market concentration and some of its implications. In most industries, according to the CEA, standard metrics show large – and in some cases, dramatic – increases in market concentration. The top ten banks’ share of the deposit market, for example, increased from about 20% to 50% in just 30 years, from 1980 to 2010.

Some of the increase in market power is the result of changes in technology and economic structure: consider network economies and the growth of locally provided service-sector industries. Some is because firms – Microsoft and drug companies are good examples – have learned better how to erect and maintain entry barriers, often assisted by conservative political forces that justify lax anti-trust enforcement and the failure to limit market power on the grounds that markets are “naturally” competitive. And some of it reflects the naked abuse and leveraging of market power through the political process: Large banks, for example, lobbied the US Congress to amend or repeal legislation separating commercial banking from other areas of finance.

The consequences are evident in the data, with inequality rising at every level, not only across individuals, but also across firms. The CEA report noted that the “90th percentile firm sees returns on investments in capital that are more than five times the median. This ratio was closer to two just a quarter of a century ago.”

Joseph Schumpeter, one of the great economists of the twentieth century, argued that one shouldn’t be worried by monopoly power: monopolies would only be temporary. There would be fierce competition for the market and this would replace competition in the market and ensure that prices remained competitive.

My own theoretical work long ago showed the flaws in Schumpeter’s analysis, and now empirical results provide strong confirmation. Today’s markets are characterized by the persistence of high monopoly profits.

The implications of this are profound. Many of the assumptions about market economies are based on acceptance of the competitive model, with marginal returns commensurate with social contributions. This view has led to hesitancy about official intervention: If markets are fundamentally efficient and fair, there is little that even the best of governments could do to improve matters. But if markets are based on exploitation, the rationale for laissez-faire disappears. Indeed, in that case, the battle against entrenched power is not only a battle for democracy; it is also a battle for efficiency and shared prosperity.

Joseph E. Stiglitz, recipient of the Nobel Memorial Prize in Economic Sciences in 2001 and the John Bates Clark Medal in 1979, is University Professor at Columbia University, Co-Chair of the High-Level Expert Group on the Measurement of Economic Performance and Social Progress at the OECD, and Chief Economist of the Roosevelt Institute. A former senior vice president and chief economist of the World Bank and chair of the US president’s Council of Economic Advisers under Bill Clinton, in 2000 he founded the Initiative for Policy Dialogue, a think tank on international development based at Columbia University. His most recent book is The Euro: How a Common Currency Threatens the Future of Europe.

Our Comment

To hear today’s finance gurus reporting on the markets, one would think that the markets, like corporations, should be considered persons – persons, indeed, of superior intellect and authority!

How refreshing, to read Glitz’s clarification of the reality that markets lead – not to “marginal returns commensurate with social contributions” – but to monopoly.

The neoliberal rational for laissez-faire has been the excuse for many destructive policies, not the least of which are those responsible for the disastrous exploitation of the environment.

We can hardly hope to wage a serious “battle against entrenched power” without reversing their key monopoly – the monopoly over money creation!

Élan

Canadian Cities Push Back on Plans for Infrastructure Bank

By Bill Curry, Ottawa – The Globe and Mail, October 25, 2016

Canada’s municipalities are pushing back against plans for a $40 billion federal infrastructure bank, warning Ottawa that it should not be capitalized with the billions of dollars the Liberals have already promised cities for transit, bridges and other projects.

Finance Minister Bill Morneau’s advisory council on economic growth – which has worked directly with top federal officials for months – released a report last week calling for the creation of a new infrastructure development bank that would bring public and private money together to build major projects across the country.

The council said Ottawa should capitalize the bank with at least $40 billion over 10 years and predicted that would leverage a further $160 billion – if not more – in private capital.

The report was silent though as to how the federal government should come up with the $40 billion. In interviews, two members of the council – Mark Wiseman, senior managing director of BlackRock Inc. who was recently the head of the Canada Pension Plan Investment Board, and Michael Sabia, president and CEO of the Caisse de dépôt et placement du Québec pension fund – said that decision is up to the federal government. But both suggested the money could come from the existing federal pledge to spend $60 billion in new funds on infrastructure over 10 years.

The challenge for the federal cabinet is that some of that $60 billion has already been spent on what it called Phase 1 of its infrastructure plan. Negotiations toward a second phase that would allocate the remaining $48 billion are already welladvanced with provinces and municipalities, who are expecting to hear details this fall. Federation of Canadian Municipalities president Clark Somerville said Monday the proposed bank should be funded independently of the Phase 2 infrastructure plan.

“FCM has been working closely with the federal government to ensure Phase 2 provides predictable funding for urgent local priorities like transit, housing and green infrastructure,” he said in a statement to The Globe. “Based on these conversations, we expect the infrastructure bank would serve as an additional financing mechanism, above and beyond the $48 billion core investment committed for Phase 2.”

The pushback from municipalities highlights how difficult it is for the federal government to reach agreements on infrastructure proposals and get projects off the ground.

While Mr. Morneau has said the idea of an infrastructure bank makes “eminent sense,” he has not formally committed to the concept. That could potentially happen either on November 1, when he delivers a fall economic update, or November 14 when government officials meet with the leaders of several institutional investment funds to talk about Canada’s infrastructure plans. A spokesperson for Mr. Morneau said it is too early to discuss how the minister might respond to the council’s recommendations.

In an interview, Mr. Sabia – the head of Quebec’s $255 billion pension fund – said Ottawa doesn’t need to find the entire $40 billion right away. He said the priority should be to get the institution running as soon as possible so that it can gain investor confidence as a professional and independent source of expertise.

He described the concept as one that would avoid political intervention because the bank would be free to manage a project once it has been approved by government.

“This is a really important change in how infrastructure would be done in Canada,” he said.

Mr. Sabia said criticism of some publicprivate infrastructure projects, such as the initial contract for Ontario’s 407 toll highway, is valid, but an infrastructure bank staffed with experts could negotiate contracts that are positive for investors and the public interest.

“It’s wrong to think about this bank purely as a financial institution. This bank is intended by us to also be a national centre of expertise on infrastructure,” he said.

Canadian pension funds have been steadily adding infrastructure investments to their portfolios, buying airports, toll roads, bridges and shipping ports around the world.

But direct infrastructure investing is still relatively new for the country’s largest institutional investors. CPPIB did its first infrastructure investments in 2004, but had $21.3 billion – or 7.6 percent of the $278.9 billion CPP fund’s assets – allocated to infrastructure at the end of March this year. The Caisse had about $13 billion worth of infrastructure in its portfolio at the end of last year, while the Ontario Teachers’ Pension Plan had $15.7 billion invested.

The pension funds are less often involved in public-private partnership deals to develop local infrastructure such as hospitals, prisons and transit because these are debtheavy financings where the equity portion of the deal isn’t large enough to move the needle for the big plans.

Mr. Wiseman, who left as head of the CPPIB in June to join BlackRock, said the council proposed $100 million as a minimum size for projects that would be supported by the bank because institutional investors need scale.

While the council said the infrastructure bank could raise $4 in private capital for every $1 invested by Ottawa, he outlined several scenarios where federal investments could be leveraged to even greater amounts.

Institutional investors are looking for large projects and predictability in terms of revenue and regulation, he said. “This is about building the type of national infrastructure, the type of urban transportation, that will essentially serve the country for decades to come,” he said.

Andrew Claerhout, head of infrastructure and natural resources at Teachers, is heavily in favour of the infrastructure bank proposal. However he expressed concern that the plan could “get whittled down in multiple places, such that it’s no longer effective. That would be the thing that would keep me up at night.”

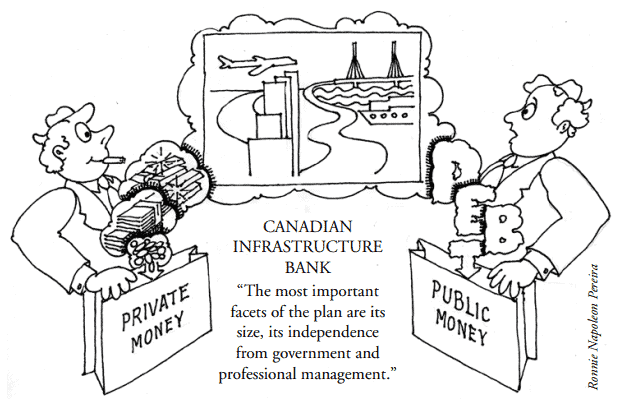

The most important facets of the plan are its size, its independence from government and professional management, he said.

Mr. Claerhout added that the government should not only share in the risk of the projects, but should also share in the rewards to avoid leaving the bad taste in any mouths that private investors profited at the cost of government. If the government can turn a profit, support for future projects with an institution such as Teachers is more likely, he reasons.

Our Comment

Public-private partnerships have a history of cautionary tales.

In December 2014, Ontario’s Auditor General, Bonnie Lysyk, blasted the Liberals’ use of private money to finance new hospitals and transit, revealing that Infrastructure Ontario’s use of P3s had cost $8 billion more taxpayer dollars than traditional public financing would have (Toronto Star, December 9, 2014, quoted by Joyce Nelson, COMER, March-April 2016).

“P3’s are not really about government financing because of scarce money, but another con job by the corporations to expand their operations in order to enhance shareholder value. It is made to look like governments are asking for this form of help when in fact it serves the corporate interests for never-ending growth on a finite planet” (Herb Wiseman, quoted by Joyce Nelson, COMER, March-April 2016).

What opportunities has the average Canadian had to learn about P3s? It would be instructive to find out what one’s MP knows and thinks about them!

It might be equally constructive both for one’s MP and oneself to ask about “leveraging $160 billion plus in private capital. At what cost? Who would pay? Who would benefit? And, where will that initial $40 billion come from?

The makeup of the advisory board, and the plan so far revealed, portend a global feeding frenzy for big-thinking, long-term oriented corporations, that would lead, ultimately, to a global gobble-up of national assets for corporations, and a zooming debtload for nation states on the “road to debt serfdom” (term coined by Friedrich von Hayek).

The expectation that the infrastructure bank “would serve as an additional financing mechanism above and beyond $48 billion core investment” exposes the potential cash-cow function of the bank.

Remember Blackrock, the world’s biggest investor, and the single biggest shareholder in Bank of America?

“Governments in the US, Greece, and Britain, went there for advice on what to do with toxic assets” from crashing banks, even though Larry Fink, its co-founder, chair and CEO, “was an early and vigorous promotor of the same mortgage-backed securities responsible for the crisis.” Now his firm is making millions cleaning up these toxic assets (Joyce Nelson, COMER, March-April 2016).

Given that, for Finance Minister Bill Morneau, the idea of an infrastructure bank makes “eminent sense,” it might be interesting to ask him why?

“The priority should be to get the institution running as soon as possible so that it can gain investor confidence as a professional and independent source of expertise….” Independent of whom? Of what?

“This is a really important change in how infrastructure would be done in Canada.”

No kidding!!!

Not to be considered “purely as a financial institution,” the bank “is intended by [them] to be a national center of expertise on infrastructure.” Is that to say that the people financing it also get to negotiate what “contracts…are positive for investors and the public interest”?

Some of us may have reservations about investing Canada Pension Funds in a tollroad economy that drags taxpayers on to “the road to serfdom” (Michael Hudson, Finance Capitalism and Its Discontents).

Luckily our pension funds won’t take the P3 rout to “debt heavy financings” because that isn’t profitable enough!

What are we to make of Mr. Wiseman’s move to Blackrock?

One has to wonder what sort of guaranties institutional investors will require regarding “predictability in terms of revenue and regulation”!

“This is about building the type of national infrastructure, the type of urban transportation, that will essentially serve the country for decades to come.”

And corporations forever?

What do you suppose “[getting] whittled down in multiple places” might involve, or why that might occur?

“The most important facets of this plan are its size, its independence from government and professional management.”

The ultimate neoliberal paradise!

What, I wonder, would be the government’s negotiated share of risk and profit?

Let your MP know how you feel and what you think about this proposed infrastructure bank!

Élan

Additional Comment and Quotations

Of course, we already have an infrastructure bank – one that has served us well in the past. In 1939, Graham Towers, the first governor of the Bank of Canada, confirmed that “anything physically possible and socially desirable can be made financially possible.”

From the 1940s into the mid 1970s for example, state funding through the Bank of Canada promoted a stunning era of growth in Canada’s wealth, without causing undue debt or the dreaded inflation.

Bank-created money empowered Canada’s outstanding contribution to the war effort, paid for physical infrastructure projects like the Trans-Canada Highway and the St. Lawrence Seaway, and social infrastructure projects like Old Age Pensions and universal Medicare.

Since 1974-5, in accordance with an agreement among central bankers (most of whose banks are private), at the Bank for International Settlements (BIS), Canadians have been denied that use of their central bank, and successive Canadian governments have borrowed, instead, from private banks. By 2012, that change in monetary policy had cost Canadian taxpayers more than $1 trillion in interest on the national debt alone, and created a deficit that has been the excuse for a disastrous slash-and-strangle budget policy that continues to trash all of the social progress gained over those decades prior to the ’70s.

From its inception, the Bank of Canada has been an arena of struggle over who’s boss – the government or the bank!

There has always been a concern that politicians might abuse the power to create money to manipulate the electorate in a manner detrimental to the health of the economy, hence the provision that the bank should operate at arm’s length.

“The Bank is not a government department as it performs its activities at arm’slength from the government; it is a Crown corporation owned by the Government (shares are directly held by the Ministry of Finance). The Governor and Senior Deputy Governor are appointed by the Bank’s Board of Directors. The Deputy Minister of Finance sits on the Board of Directors but does not have a vote” (Bill Abram, Money: A Servant For All Mankind: The Canadian Experience).

Article 14(2) of the Bank of Canada Act, however, makes it crystal clear that “If… there should emerge a difference of opinion between the Minister and the Bank concerning monetary policy to be followed, the Minister may…give the governor a written…and the Bank shall comply with that directive” (Abram).

“In practice, the Governor sets monetary policy independently of the government. This was not the intent of the Bank of Canada Act, as envisaged by Gerald Gratton McGeer & the writers of the Macmillan Minority Report” (Abram).

Article 91 of the Constitution Act of 1867 declares that the exclusive Legislative Authority of the Parliament of Canada extends to all Matters coming within the Classes of Subjects next hereinafter enumerated; that is to say,

Section 1A, The public debt and property

Sub 14. Currency and coinage

Sub 15. Banking, Incorporation of Banks, and the issue of paper money

Sub 16. Savings Banks

Sub 20. Legal Tender (Abram).

The purpose of the Bank of Canada is expressed in the preamble to the Bank of Canada Act. It is “to regulate credit and currency in the best interests of the economic life of the nation.”

The Bank is empowered, by Article 18 to:

c) buy and sell securities issued or guaranteed by Canada or any Province…

(i) make loans or advances…

(j) make loans to the Government of Canada or the government of any Province… (Abram).

A separate Act, Bill 143 – “The Municipal Improvements Assistance Act an Act to assist Municipalities in making self-liquidating improvements” was passed in 1938 (the year the Bank was nationalized), and was rescinded – guess when – in 1975!

In 2011, William Krehm, on behalf of COMER, filed a suit to restore the Bank to its original purpose.

The crisis of the Great Depression sparked the appointment of the Macmillan commission struck to consider the need for a central bank.

The most influential person to address that commission was Gerald Gratton McGeer, a brilliant Canadian lawyer who argued the case for the need to establish a public central bank. He campaigned across Canada to encourage public support for such a bank, and was instrumental in persuading Prime Minister Mackenzie King to promote the project.

Highly pertinent to the present moment in the history of the Bank, is this comment from his report of 1933, entitled The Toll Gate:

“The barrier that now blocks the way to progress is the misguided management of public credit by the private money system. We must wipe out that twentieth century anomaly in much the same way, and for the same reason that we wiped out toll gates and private management of public roads and highways in the nineteenth, and establish in its place national maintenance, control and regulation of the issue and circulation of public credit as the means of supplying the capital now required” (Abram).

The Bank of Canada opened in 1935. At that time, Prime Minister Mackenzie King, in a radio broadcast to the nation, quoted from the Macmillan Commission’s Minority Report:

“Once a nation parts with control of its currency and credits, it matters not who makes that nation’s laws. Usury once in control will wreck any nation. Until the control of the issue of currency and credit is restored to the government and recognized as its most conspicuous and sacred responsibility, all talk of the sovereignty of Parliament and of democracy is idle and futile…” (Abram).

The proposed Canadian infrastructure bank is being designed to guarantee the unfettered growth on which finance capitalism depends, to ensure private control over democratic governments, and to perpetuate private profit and corporate power. It is the final coup in the transfer of power from our national governments to private corporations.

The Bank of Canada was designed to entrust to a democratically empowered government the power of money to serve the common good.

Andrew Clairehout’s somewhat ingenuous acknowledgement that “the most important facets of the plan are its size, its independence of government and professional management”, pretty well reflects its true purpose.

No, the Bank of Canada won’t do! It won’t do because it belongs to Canadians and is mandated to serve the common good. The Canadian Infrastructure Bank (CIB) will belong to the neoliberal oligarchy that is behind it. It’s mandate will be to act in its best interests. It will appropriate our national sovereignty, and will trim our economic and political freedom.

The Bank of Canada is ours in trust. It is not ours to surrender. We owe it to all those Canadians, notably G.G. McGeer, who won for us that legacy, and we owe it to future generations to hand it on intact.

(Bill Abram’s handbook on money and the Bank of Canada is an excellent reference resource. If you are interested in a copy, please contact COMER at comerpub@rogers.com.)

Relevant Comments

The late Professor John H. Hotson, cofounder of COMER:

The Bank of Canada has sold out entirely to the country’s chartered banks. It is now their “wholly controlled subsidiary.” That is why it now lets the private banks create all but a factor of the nation’s money supply, and lets their income from interest grow many times faster than all other forms of income…

According to him, the fundamental rules of national finance are:

1. No sovereign government should ever under any circumstances, borrow money from commercial banks at interest, when it can instead, borrow from its own central bank interest free.

2. No federal provincial or local government should borrow foreign money when there is excessive unemployment here.

3. Governments, like businesses, should distinguish between capital and current expenditures and, when it is prudent, finance capital improvements with money the government created for itself.

Compared to other issues, how important is monetary reform? – Michael Rowbotham, The Grip of Death

“The reform of the debt-based monetary supply system is the single most important area of reform confronting us.

“Reforming the financial system is more important than the war against poverty… more important than the movement to protect the environment…the fight against drugs and racism, and the battle for social justice and welfare.

“Financial reform is more important than all these problems for the simple reason that the current financial system is responsible, both directly and indirectly for causing, or at least exacerbating them.”

Élan