By David Oakley and Norma Cohen, Financial Times, October 16, 2012

Employees face a much greater risk their pensions will not pay out than regulators have made assumptions for, amid growing efforts by the industry to tackle the problem of underfunded schemes.

Companies such as BT Group and British Airways, which have some of the largest UK pension funds, face the biggest risks because they have mature schemes that must pay out millions of pounds to retired members every year.

Analysis by Towers Watson, a consultancy, shows that managers of defined benefit schemes, which offer a fixed annual pension, are far more exposed to the threat of volatile equity markets than had been calculated.

This is because they need nearly 30 more years before they will be able to fully “derisk” their schemes – switch out of riskier investments, such as equities, and move into safer assets like index-, or inflation-linked, bonds, which allow fund managers to offer close to guaranteed payments.

Towers Watson says UK schemes have liabilities of £2tn compared with indexlinked gilts supply of £0.5tn and that it will take until 2039 before the supply of indexlinked gilts matches liabilities.

This is much longer than the estimate of about 10 years by the UK Pensions Regulator. Schemes must match their liabilities – current and future payments – with assets, revenue from equity or bonds, to make sure they can meet all their pension obligations.

Although schemes use other fixed income assets, such as conventional gilts and corporate bonds to match liabilities, index- linked government bonds are thought the best instruments to buy as they guard against inflation and are also considered almost risk free.

Fund managers have reduced the amount of equities they hold to 40 percent from 60 percent since 2006, but some want to cut their exposure further, as the recent rollercoaster ride in equity markets has put pressure on deficits and increased fears over the ability of schemes to pay out.

BT, which has suffered from the sharp falls in equity markets, was this year forced to make a £2bn payment to halve a pension “black hole,” but fund managers say the company’s scheme is likely to remain underfunded, or without enough money to guarantee pensions will be paid in full, for years.

Alasdair MacDonald, head of investment strategy at Towers Watson, said: “Some pension schemes may not need to remove all their risk because they have plenty of time before their members retire, but those mature schemes that have to make payments to pensioners every month are more likely to want to take as much risk off the table as possible.

“They need guaranteed fixed income payments, protected from inflation, so they can pay their retired members.”

Worries over the lack of suitable assets to match liabilities has prompted the National Association of Pension Funds, which represents 1,200 pension schemes with combined assets of nearly £800bn, to look at alternative ways to match liabilities with safe assets, such as the creation of a debt market linked to infrastructure projects.

Joanne Segars, chief executive of the NAPF, said: “There is simply not a big enough supply of index-linked bonds. We need other gilt-like instruments to help schemes match liabilities. We are currently looking at other assets, such as infrastructure instruments, that might offer ways to de-risk portfolios.”

The Towers Watson calculations are based on UK Debt Management Office projections and assumptions that index-linked issuance will remain constant.

Separately, on Tuesday, the National Association of Pension Funds warned that workers’ pension pots were at risk of losing up to a quarter of funds under the government’s pension plans, as workers switched jobs and schemes. The charity called for a low-cost “aggregator scheme” where savings could be pooled in a single place.

Steve Webb, minister for pensions, said: “Far too many people have absurdly small amounts of money scattered between far too many pension schemes. I am determined to make sure that people start to build up decent pension pots and keep track of them.

“For too long, an overly complex system has made it hard for people to transfer their money between pension schemes. We need a big shake-up to make it safe, cost-effective and easy to move your pension pot around.”

Massively underfunded public and private pensions, and all the risks inherent therein, have been a frequent topic of conversation for us recently. Today, Tobias Levkovich at Citigroup published a report pointing out just how dire the situation is for the S&P 500’s largest corporate pension funds. The study found that pensions of just the companies in the S&P 500 alone were over $375BN underfunded at the end of 2015 with the top 25 underfunded plans accounting for over $225BN of the underfunding. Moreover, Citi pointed out that pensions don’t seem to be participating in the massive equity rally that has grown ever so “bubbly” since 2009 and issue we explained in detail here:

Pension Duration Dilemma – Why Pension Funds Are Driving the Biggest Bond Bubble In History

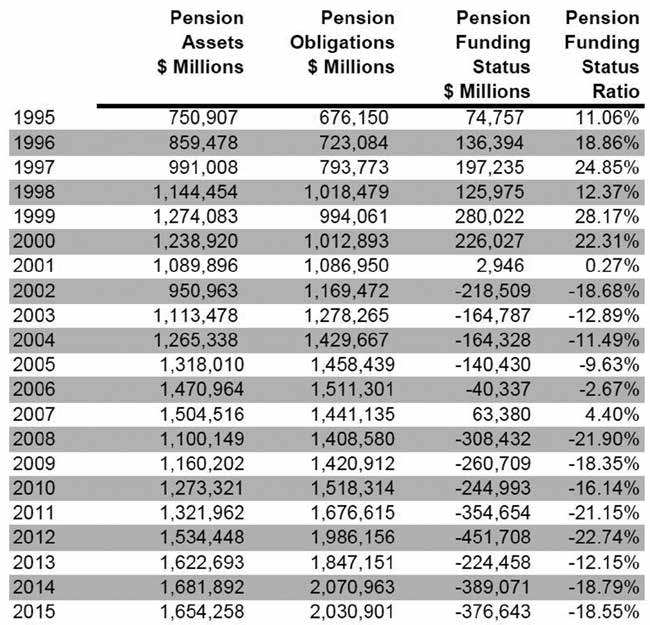

Pension under-funding continues to be a major issue for S&P 500 constituents as very respectable equity market gains over the last seven years have not substantially alleviated pension pressures. The S&P 500 has appreciated by more than 200% at the end of 2015 since the low in March 2009 but the aggregate underfunded status of $376 billion in December 2015 is now 22% higher than the $308 billion underfunding peak seen in December 2008 (see Figure 1). While the funding status in 2013 recovered by more than $225 billion versus 2012 alongside strengthening equity market performance and a higher discount rate, this trend reversed in 2014 and only improved moderately in 2015.

Specifically, the slightly higher discount rate contributed to the progress in 2015’s pension funding status, not higher equity prices.

Per the table below, S&P 500 corporate pensions went from being fully funded in 2007, in aggregate, to $375BN underfunded in just 8 years.

The primary problem, of course, is the Fed’s low interest rate policies which are crushing both sides of the pension equation.

Pension assets have basically stagnated since 2007, up less than 10%, as pensions struggle to “find yield.” Meanwhile, lower yields on corporate bonds have driven discount rates through the floor causing the present value of liabilities to skyrocket over 40% over the same period.

Figure 1: S&P 500 Pension Breakdown

Source: FactSet, S&P Dow Jones Indices LLC and Citi Research – US Equity Strategy

After dipping in 2014, the discount rate rose modestly in 2015, causing pension obligations to ease but pensions remain severely underfunded. The present value of corporate pension obligations is heavily influenced by interest rates and thus lower yields typically cause deterioration in funding status. While forecasts for higher yields in the future should lead to decreased concerns over the underfunded status of US pensions, Other Post Employment Benefit

(OPEB) accounts remain significantly under-funded as corporations attempt to shift these costs onto individuals, but that may take some time.